Margin Call Forex

Margin merupakan jumlah uang yang anda perlukan untuk mempertahankan suatu posisi dalam trading agar tetap terbuka. The margin call level is equivalent to 100° c, which is a specific temperature.

การคำนวณจุดล้างพอร์ท หนังสือ Forex

การคำนวณจุดล้างพอร์ท หนังสือ Forex

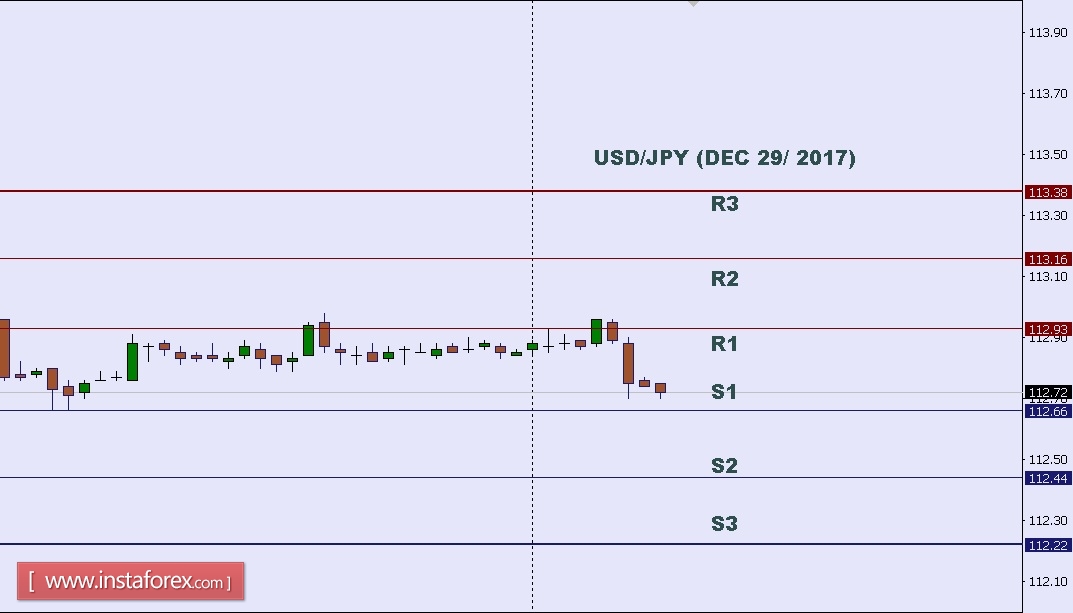

A forex broker uses a specific margin level to determine whether a trader can open any new positions or not.

Margin call forex. What is margin call in forex trading? Jadi, margin call merupakan sebuah fasilitas broker yang memperingatkan trader jika ekuitas akun sedang terancam oleh floating loss dari posisi trading saat ini. The broker sets margin call levels in forex at 20% and stop out is at 10%.

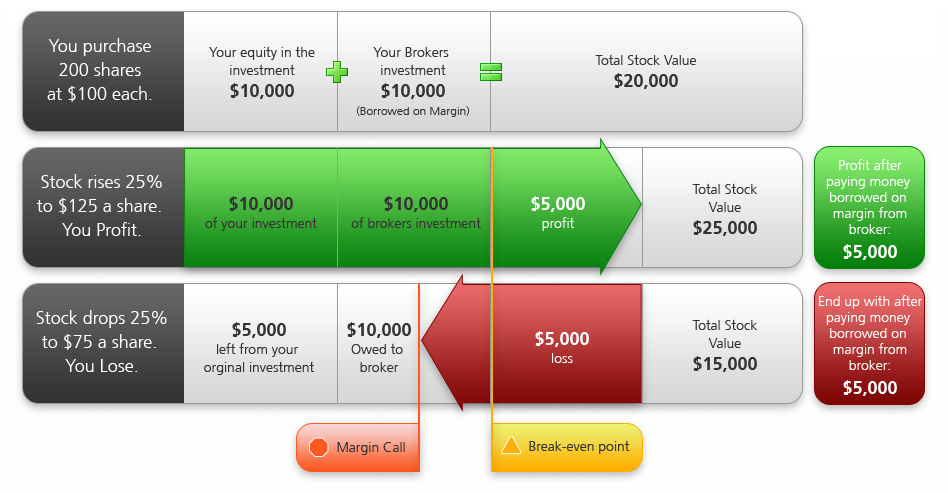

Margin call margin call in forex trading represents a situation when the trading loss approaches to the marginal deposit amount or the trading loss cross that marginal reserve amount, the forex broker’s trading software automatically close out the trade. Forex margin call & closeout calculator. A margin call is usually an indicator that one or more of the securities held in the margin account has decreased in value.

A margin call occurs when a trader is told that their brokerage balance has dropped below the minimum equity amounts mandated by margin requirements.traders who experience a margin call must quickly deposit additional cash or securities into their account, or else the brokerage may begin liquidating the trader's positions to cover margin requirements. You can find both figures listed at the top of the ig platform. If you see a tool tip next to the leverage data, it is showing the max leverage for that product.

Get a rough estimate of the hypothetical exchange rate that would cause a margin closeout for a specific trade, and its corresponding loss. The margin close out (mco) process differs by trading platform. For instance, if traders have 50 times leverage, they can control $50 for every $1.

The margin calculator will help you calculate easily the required margin for your position, based on your account currency, the currency pair you wish to trade, your leverage and trade size. Margin is usually presented as a percentage amount of the full position—0.25%, 0.5%, 1%, 2%, and so on. Margin can be seen as a deposit or insurance, the minimum amount of money your broker requires in order to open a leveraged position.

Untuk mengenal lebih dalam tentang margin call, wajib hukumnya bagi anda untuk memahami margin.jika dalam definisi umum seperti yang sudah dipaparkan, pada trading forex pengertian ini sedikit berbeda. Reduce your effective leverage.at dailyfx, we recommend using ten to one leverage, or less. Margin is the amount of money that a trader needs to put forward in order to open a trade.

20% of the margin amount is 40usd, 10 % is 20 usd. A margin call is equivalent to water boiling, the event when the liquid changes into a vapor. With a pip value of $10 per pip (1 lot = 100,000 value and 100,000 x 0.0001 points = $10), margin call can only be issued when the position is negative by 900 pips ($45,000 usable margin divided by $50/pip, since chris has assumed a position of 5 lots).

Di sini, kamu membuka posisi dengan nilai $100. We introduce people to the world of currency trading, and provide educational content to help them learn how. Margin call level at 100%.

After the margin call this is how your account will look: Margin is not a cost or a fee, but. Margin call (mc) adalah sistem peringatan jika ekuitas akun trading sudah tidak mencukupi nilai margin yang dibutuhkan untuk membuka posisi (margin requirement).

The trader tops up the deposit with 300 usd and uses the leverage of 1:100, opening a position of 20,000 usd. Diasumsikan bahwa kamu membuka akun forex reguler dengan dana $500. This specific limit or threshold is known as a margin call level, which is a specific value of the margin level.

Margin has often been labeled a “good faith deposit” to open a position. Margin call prevents from losses exceeding trader's deposit. In order to understand what margin call means in forex, you need to know some of the other margin terms.

Maximum leverage and available trade size varies by product. Margin is one of the most important concepts to understand when it comes to leveraged forex trading.margin is not a transaction cost. Banyak trader pemula masih bingung dengan ketiga istilah tersebut, terutama karena semuanya berhubungan dengan ketahanan dana selama trading.

When a margin call occurs, the investor must choose to either deposit. It is essentially the deposit for a larger position. Ilustrasi ini bakalan memberikan gambaran sederhana, tapi cukup menjelaskan sehingga kamu lebih memahaminya.

Margin and margin requirements are something that no forex trader can afford to ignore. When trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade. Pada artikel sebelumnya, kita sudah membahas tentang pip, lot dan perhitungan profit/loss.sekarang, marilah kita pahami lebih lanjut tentang perhitungan margin, leverage, juga pengertian dan perhitungan margin call.

The margin the margin is an important part of the forex. What is margin call in forex? Babypips.com helps individual traders learn how to trade the forex market.

What does margin call level mean? Margin is the small bit of capital that a broker sets aside in order for a trader to open a position. Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies.

Top 4 ways to avoid margin call in forex trading:. Let’s say your forex broker has a margin call level at 100%. The own funds, need to open such a position is 1/100 from 20 000, that is 200 usd.

(this tool assumes there are no other open trades.) find out about margin rules. Untuk menjelaskan lebih detail tentang apa itu margin call, kamu bisa memperhatikan ilustrasinya. If the broker is not worried about your financial condition, it may give you time to deposit new cash or securities in your account to raise the equity value to a level.

The margin level set for a trader, differs between brokers, but most brokers set this. Learn more about the mco for forex.com's proprietary platform or metatrader 4. A margin call is most often issued these days by placing a large banner or notification on the website when an investor or speculator logs in to check their account balance.

Forex Margin Call Level The Forex Scalping Strategy Course

Forex Margin Call Level The Forex Scalping Strategy Course

What is Forex Margin and Margin Call?, Forex Terms, Lesson

What is Forex Margin and Margin Call?, Forex Terms, Lesson

What is a day trading margin call, trade currency fidelity

What is a day trading margin call, trade currency fidelity

What is Margin Call in Forex? Finance Notes

What is Margin Call in Forex? Finance Notes

What is Margin Call In Forex Trading Business Basics

What is Margin Call In Forex Trading Business Basics

Warning Different Forex Brokers Have Different Margin

Warning Different Forex Brokers Have Different Margin

Memahami Margin Call Trading Forex Suka Trading

Memahami Margin Call Trading Forex Suka Trading

What is a Forex margin call, and why should you avoid it?

What is a Forex margin call, and why should you avoid it?

Sering Margin Call? Gunakan Risk dan Money Management

Sering Margin Call? Gunakan Risk dan Money Management

Margin call Forex But......... Part 1 YouTube

Margin call Forex But......... Part 1 YouTube

Margin Calls What Are They and How to Avoid Them? Forex

Margin Calls What Are They and How to Avoid Them? Forex

Arti Margin Call & Tanda Margin Call Sekolah Forex

Arti Margin Call & Tanda Margin Call Sekolah Forex

Forex Margin Call Nedir Forex System No Loss

Forex Margin Call Nedir Forex System No Loss

Margin in Forex Trading & Margin Level vs Margin Call

Margin in Forex Trading & Margin Level vs Margin Call

4 Ways to Avoid Margin Calls Forex Signals No Repaint

4 Ways to Avoid Margin Calls Forex Signals No Repaint

Comments

Post a Comment