Pattern Candlestick Forex

There are times when the forex candlestick is neither bullish nor bearish. Avoid trading on candle pattern appear bullish and bearish not consistent.

Identifying Some Forex Candlestick Patterns Best Forex

Forex candlestick patterns bottom line.

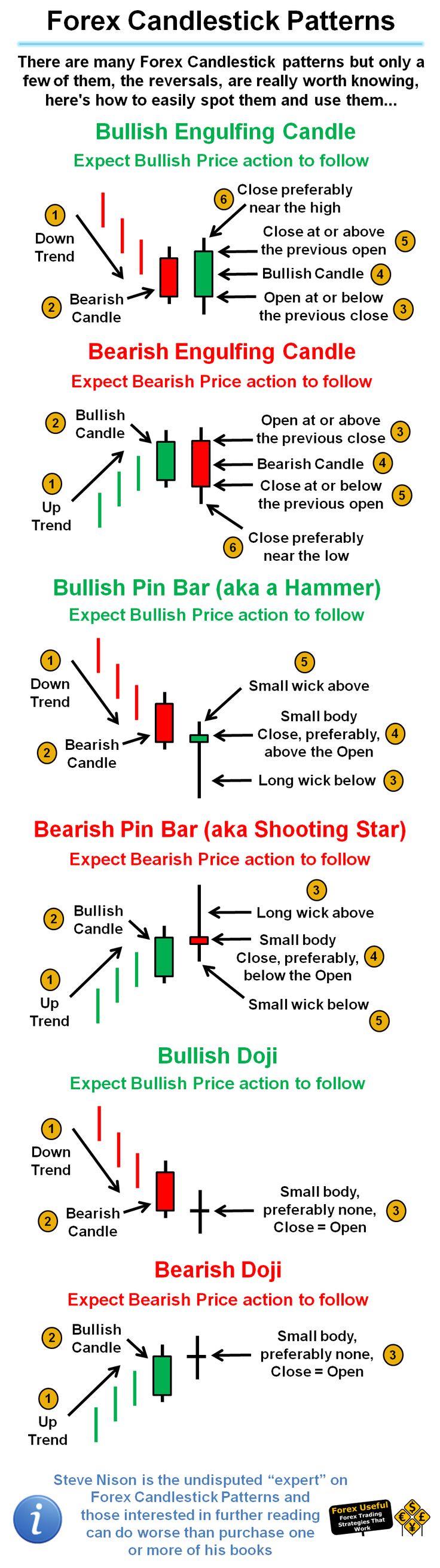

Pattern candlestick forex. The candlestick formed is called the doji. It takes the shape of a “plus” sign. There are two types of pin bar:

The candle is composed of a long lower shadow and an open, high, and close price that equal each other. The pattern comes at the end of bullish trends and signals the beginning of a fresh bearish move. The tweezer tops is a double candlestick pattern forex indicator with reversal functions.

The doji candlestick, or doji star, is a unique candle that reveals indecision in the forex market. The final candlestick pattern which we are going to cover, and also one of the most important forex chart candlestick patterns, is the doji pattern. The doji pattern is a specific candlestick pattern formed by a single candlestick, with its opening and closing prices at the same, or almost the same level.

When faced with this pattern, forex traders can immediately deduce that the market's control is no longer in the hands of the bullish forces. It is pretty rare to find, but it is pretty reliable when it does happen. Instead, it is a candlestick with short wicks and a negligible body.

This candlestick pattern looks like it sounds, the parents have walked off and left the baby behind! This candlestick has two reversal candles. Hanging man candlestick pattern can be regarded as the hammer pattern’s bearish equivalent (that shows bullish signals).

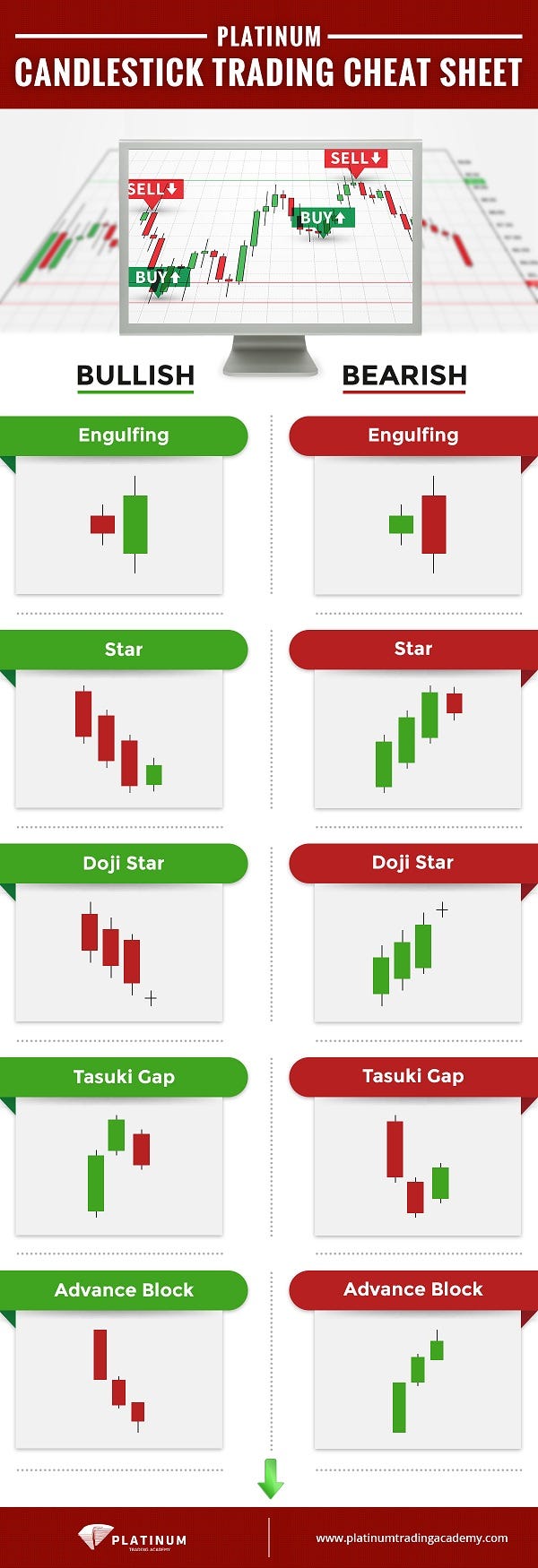

This is a reversal pattern which can occur at the end of a run in prices. A candlestick pattern refers to the shape of a single candlestick on a chart that can indicate an increase in supply or demand. When used in conjunction with trends and simple support/resistance levels, forex candlestick patterns become one of the simplest and most powerful analysis tools available.

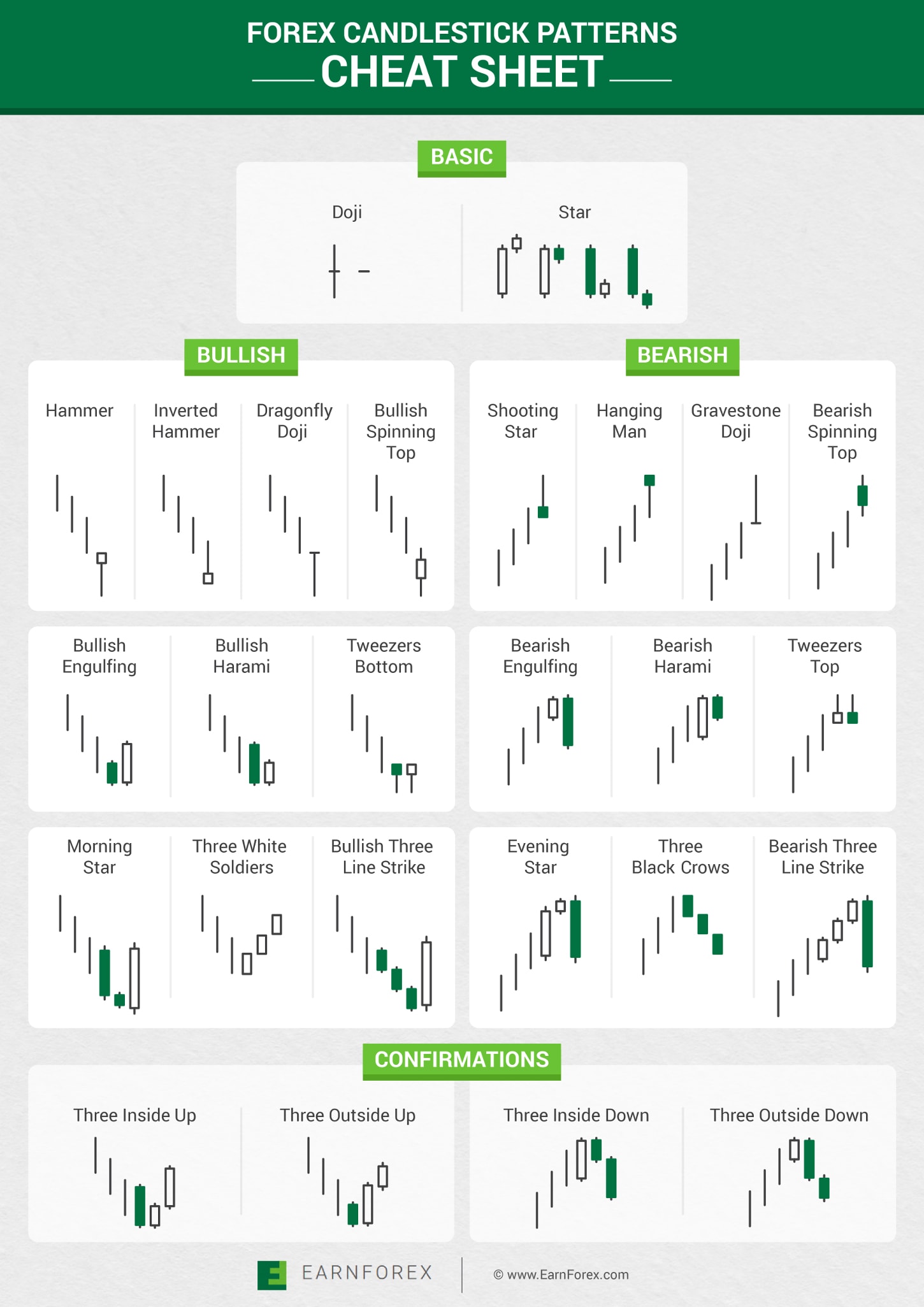

Automatically scans the charts no matter which time frame you put it on and it will show you exactly where there are specific candlestick pattern formations such as the evening doji star, evening star, shooting star, bearish engulfing pattern, dark cloud pattern, etc… The forex candlestick patterns method: The candlestick chart can demonstrate the attitudes and thinking patterns of forex traders in the market.

For example, if a market makes a new high as shown in the image. If you don’t know what’s a candlestick pattern, you can refer to our comprehensive forex technical analysis tutorial. Are forex candlestick patterns reliable?

In the next following lessons, we will take a look at specific japanese candlestick patterns and what they are telling us. Spinning top candlestick pattern in forex, you may consider the doji and the spinning top as having the same potential for reversal. Candlestick pattern chart is most power idea for trading and play key role in turning points in any market pair.

The bullish pin bar is for buy signal. Here is the screenshot of pin bar. As it appears after a rally, it takes the form of a bearish reversal indicator.

What makes them the preferred chart type for many forex traders is that every single candlestick contains information about the opening price, closing price, the highest price point, and the lowest price point for every given period. Today, we will look at the top 15 reversal candlestick patterns that you can totally use to predict the coming trend of a currency pair. This pattern looks like the hammer pattern as well.

Or a pattern that is made of of 2 or more candlesticks. The hammer candlestick pattern is frequently observed in the forex market and provides important insight into trend reversals. Forex traders who study these patterns, their shapes, compositions, and meanings for prices can make decisions regarding buying and selling as they see these patterns take shape.

How the forex candlestick pattern indicator works. Forex candlesticks originated from japan a very long time ago, and they have become popular since then. Each candlestick pattern mentioned in this article signifies a different movement or action in the market.

And key to spotting trend reversal in forex or confirm a trade. Trading success is all about following your trading rules. It’s crucial that traders understand that there is more to the.

Meskipun demikian, tidak menutup kemungkinan bahwa pola candlestick dapat diikuti oleh reversal (pembalikan arah) untuk jangka waktu yang lebih panjang. Bullish pin bar(yellow highlight) bearish pin bar. The first candle of the tweezer top candlestick formation is usually the last of the previous bullish trend.

It appears in a downtrend pattern. Pin bar the name says it all about the shape. It is recommended to trade the bullish pin bar pattern during retracement.

Yes, but the reliability of a pattern greatly depends on where it forms on the chart. The bearing pin bar is. A dragonfly doji is a candlestick pattern that signals a possible price reversal.

10 top 5 types of doji candlesticks Now, there’s a big difference between candlestick patterns and chart pattern: It forms a pattern when the small candle is followed by the large one.

When bearish candlestick pattern appear twice on chart it is a signals of bearish and downtrend. It helps to make reliable trade. Forex line candle pattern will be disappeared if current candlestick move lower or higher than.

Using reversal candlestick patterns in forex correctly can have a noticeable positive impact on a trader’s performance. However, the price was still pushed up by buyers on the market. Meskipun cukup melelahkan untuk mempelajari grafik ini, tapi itu semua akan sangat bermanfaat saat anda melakukan transaksi dalam trading.

You also can understand complete about candlestick chart pdf for more details with trading role and daily market trend analysis in forex. Candlestick patterns indicators 2021 guide you about candle next target in term of analysis. The second candlestick pattern engulfs the body of the first candlestick.

Hopefully, by the end of this lesson on candlesticks, you will know how to recognize different types of forex candlestick patterns and make sound trading decisions based on them.

Candlestick Reversal Patterns stocktrading in 2020

Candlestick Reversal Patterns stocktrading in 2020

Forex Candlestick Basics Knowledge That Made Trading Easy

67 best Trading patterns images on Pinterest Finance

67 best Trading patterns images on Pinterest Finance

Forex Candlestick Patterns Course + Cheat Sheet

Forex Candlestick Patterns Course + Cheat Sheet

The Best Candlestick Patterns Candlestick Types Forex

The Best Candlestick Patterns Candlestick Types Forex

Forex Candlestick Reversal Patterns And How To Use Them

Forex Candlestick Reversal Patterns And How To Use Them

Why Do Candlestick Patterns Work? Learn To Trade Price Action

Forex Candlestick Patterns Explained With Examples

Forex Candlestick Patterns Explained With Examples

50+ best Trading Candlestick Patterns images by GA on

50+ best Trading Candlestick Patterns images by GA on

Common Forex Candlestick Patterns Visual.ly

High Probability Forex Candlestick Patterns Forex

Forex Candlestick Patterns Course + Cheat Sheet MyFXinfo

Forex Candlestick Patterns Course + Cheat Sheet MyFXinfo

FOREX CANDLESTICK PATTERNS BASICS — KEY INFORMATION YOU

FOREX CANDLESTICK PATTERNS BASICS — KEY INFORMATION YOU

Forex Candlestick Patterns And What They Mean » FinmaxFX

Forex Candlestick Patterns And What They Mean » FinmaxFX

The Most Profitable and Proven Candlestick Patterns

The Most Profitable and Proven Candlestick Patterns

Trade With Japanese Reversal Candlestick Patterns Best

Top 10 Forex Candlestick Patterns Introduction for

Top 10 Forex Candlestick Patterns Introduction for

Forex Candlestick Patterns Cheat Sheet

Forex Candlestick Patterns Cheat Sheet

10 Best Forex Advanced Anese Candlesticks Patterns Cheat

10 Best Forex Advanced Anese Candlesticks Patterns Cheat

Comments

Post a Comment