Divergence Forex Strategy

Forex trading strategies installation instructions. What is divergence?divergence highlights places where momentum is slowing and is likely to reverse.

Talking about signs of the divergence trading strategy.

Divergence forex strategy. Divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. This system has rather fuzzy entry and exit points, but it's easy to spot the signal and the trades can be rather. This is a technical strategy and to use it you’ll just need an oscillator such as macd, stochastic or rsi.

These indicators offer a simple method of recognizing patterns and predicting which way the price will trend. Forex trading strategy combining the moving average convergence divergence. The same 50 level divergence principle can be applied on divergence day trading strategy, hourly chart, or daily chart.

Stochastic forex trading strategy divergence suggests spotting convergences and divergences between the price bars and the main indicator line. The reason i’m investing whenever explaining what i did above was just to hopefully open your eyes regarding just exactly how complex choosing whether or not a spike will proceed, can be. You obtain not so much incorrect signs.

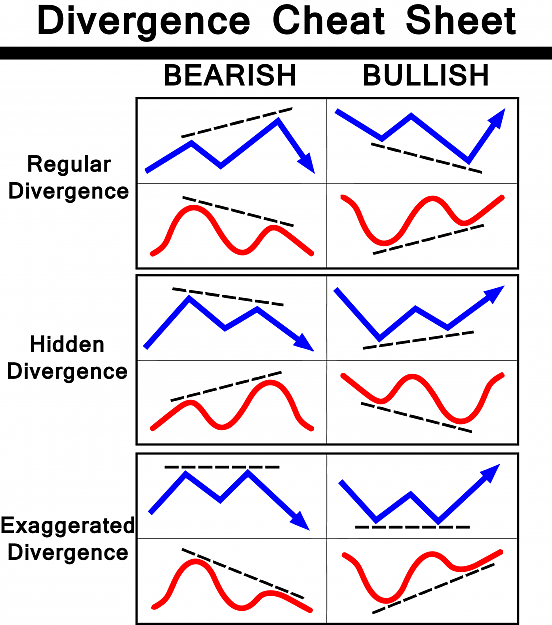

Forex event driven trading divergence, my divergence trading strategy explained (live forex trade). The entry level is marked with the blue. Classic (regular) bearish (negative) divergence is a situation in which there is a upward trend with the simultaneous achievement of higher highs.

How to trade with gann wildhog divergence forex trading strategy. That is the mean, a small number of trades. Blue diagonal lines mark a regular bearish divergence.

If price reaches a higher high, then the indicator is supposed to reach a higher high. This is an macd divergence strategy that involves being able to correctly foresee when an asset such as a forex pair would reverse in its price. Divergence signs show a tendency to become higher correct on the prolonged frames of time.

Although the signals it generates are not that frequent, they compensate by being more accurate than many other strategies. Demarker divergence forex strategy is a combination of metatrader 4 (mt4) indicator(s) and template. Actually, the divergence between macd line and the currency pair rate is the basic signal in this strategy.

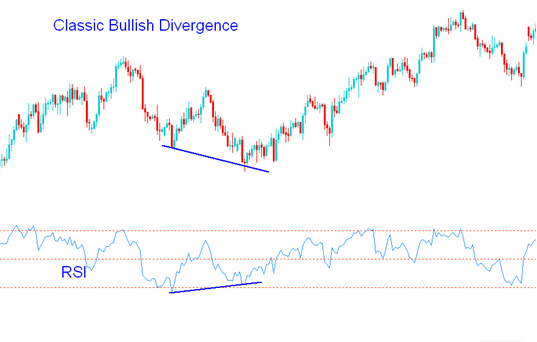

The following trading strategy is based on rsi divergences and is used to spot potential highs and lows in stock index futures. The basic idea is to look for inconsistency between the price and an oscillator. A trigger to go long on the designated forex pair.

The ins and outs of forex scalping. Enter a bullish trade if the following indicator or chart pattern gets put on display: Traders and analysts of the financial instruments, apart from the fundamentals, use a number of indicators to figure out what might happen next to the price of a certain instrument.

How do divergence and convergence look like on a chart? If the trading setup works perfectly, you have the potential to be on a trade at the very right time meaning you would have entered a short trade at the very top or a long trade at the very bottom of a swing. An additional entry signal is delivered when the indicator line goes outside the overbought zone.

Adding a method to support one’s strategy, and an analysis which has more predictive value, could be very useful. In theory, prices and indicators are supposed to go in the same direction at equal rates. Using divergence trading can be useful in spotting a weakening trend or reversal in momentum.

A divergence alone is not something that strong enough and many traders experience bad results when trading only with divergences. Dow noticed that when the dow jones industrials made new highs, the dow transportation index tends to make new highs as well and when the industrials index made new lows, the transportation index would. Demarker divergence forex strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to.

Divergence trading is an awesome tool to have in your toolbox because divergences signal to you that something fishy is going on and that you should pay closer attention. Why divergence systems work so well. Just like any trading strategy, you need to add more confluence factors to make your strategy strong.

Forex trading strategy & education. The applied divergence strategy has the best performance on long time frames such as daily, weekly, and monthly charts. Wildhog nrp divergence indicator is an oscillating custom indicator that prints divergences both on the oscillating indicator’s window and on the.

The bullish divergence rising trend started around 50 levels. Before you head out there and start looking for potential divergences, here are nine cool rules for trading divergences. In the world of forex trading, divergence is simply where the price of a particular currency pair is making new highs, but a relevant technical indicator is failing to make new highs (and starting to move lower), or where a forex pair is making new lows, but a technical.

Macd divergence forex trading strategy — is one of the quite reliable systems and is based on the standard macd indicator. Below we see how price made 2 divergences but price never sold off. The advantages of the macd divergence forex trading strategy.

Divergence forex trading strategies are frequently applied by currency traders around the globe. Sometimes you can even use it as a signal for a trend to continue! Forex divergence trading is both a concept and a trading strategy that is found in almost all markets.

Regular divergence trend reversal forex trading strategy is a combination of metatrader 4 (mt4) indicator(s) and template. This fx trading strategy is based on the concept of hidden divergences using a custom indicator that conveniently shows divergences. A forex divergence strategy is thus based on the identification of such probability of trend reversal and the subsequent analysis for revealing where and with which intensity such reversal may occur.

The essence of this forex system is to transform the accumulated history data and trading signals. The essence of this forex strategy is to transform the accumulated history data and trading signals. Recent history of the major currency pairs shows evidence that divergence signals are often exceptionally useful.

Using the moving average convergence divergence indicator (macd) is a good place for you to begin your analysis. It is an age old concept that was developed by charles dow and mentioned in his dow tenets.

The Power of Divergence How to Predict the Future

The Power of Divergence How to Predict the Future

Divergence With RSI Indicator HowTo and Trading Setups

Divergence With RSI Indicator HowTo and Trading Setups

Forex Safe Zone Strategy Pdf Forex Ea Writer

Forex Safe Zone Strategy Pdf Forex Ea Writer

RSI Estrategia Forex Trading divergencia Indicadores MT4

RSI Estrategia Forex Trading divergencia Indicadores MT4

Forex divergence strategy & Indicator MT4 Divergence

Forex divergence strategy & Indicator MT4 Divergence

How to use MACD Indicator to Trade Stock & Binary Options

How to use MACD Indicator to Trade Stock & Binary Options

A Divergence Trading STRATEGY (That Actually Works

A Divergence Trading STRATEGY (That Actually Works

Divergence In Forex Pdf Forex Scalping Edge

Divergence In Forex Pdf Forex Scalping Edge

Divergence / Hidden Divergence Technik traderforum.ch

Forex Price Action with CCI Divergence Strategy YouTube

Forex Price Action with CCI Divergence Strategy YouTube

Top 20 Best Forex Trading Strategies that Work Even for

Top 20 Best Forex Trading Strategies that Work Even for

Works on All Time Frame Forex MACD Divergence Trading

Works on All Time Frame Forex MACD Divergence Trading

The Power of Divergence How to Predict the Future

The Power of Divergence How to Predict the Future

Forex Divergence and Convergence Article contest

Forex Divergence and Convergence Article contest

Navin Divergence Indicator Mt4

Navin Divergence Indicator Mt4

Forex Divergence Strategies Best Free Forex Scalper Ea

Learn Forex Three Simple Strategies for Trading MACD

Learn Forex Three Simple Strategies for Trading MACD

Forex hidden divergence system

Comment trader la Divergence RSI Guide Complet 2019

Comment trader la Divergence RSI Guide Complet 2019

Comments

Post a Comment